Translator’s Note: Modern China is a rapidly developing country premised upon the Marxist model of transformation. China has thrown off thousands of years of feudalism and is quickly catching-up with the developed (capitalist) West. As an exploited and colonised country – China has chosen the correct path of anti-colonialism that makes a clean-break with Western mechanisms of direct exploitation. Yes – China interfaces with the capitalist West – and generates its own wealth through trade (as Lenin and Mao suggested). To do this, the two respective banking systems, whilst remaining separate and distinct, must possess mechanisms that reflect one another – and enable efficient interaction. As China did not possess an effective credit-rating system prior to 2012 – quite often the dishonesty of feudal times raised its head as people started hunting for profit for profit’s sake – and leaving their fellow citizens behind (an illegal act within the Socialist System). Now, China has a credit-rating system that emphasises honest interaction over dishonest exploitation. Despite the deluded Western imagination inventing all kinds of delirious speculations – encouraging honesty is the only reason for the Chinese credit-rating system. ACW (25.9.2025)

People’s Credit Network

22-08-2025 – Hebei

The People’s Credit Evaluation System is a tool that evaluates the credit status of individuals or enterprises through quantitative analysis, and is widely used in finance, enterprise management, market supervision and other fields.

Basic Definitions

The People’s Credit Evaluation System is an important part of the construction of China’s Social Credit System, aiming to evaluate the comprehensive credit status of economic entities through a set of relevant indicator systems – designed to promote social integrity and standardized management. In accordance with the principles of “impartiality, objectivity, science, and openness”, through comprehensive understanding, investigation, research, and analysis of credit subjects, estimates of the reliability and security of credit behaviour are made, and expressed in the form of special symbols or words.

System Functions

Credit Evaluation: The system conducts a comprehensive analysis and evaluation of the basic quality, operating level, financial status, profitability, management level and development prospects of enterprises and financial institutions to determine their ability and trustworthiness to fulfil various economic contracts.

Credit History: The system records an individual’s credit behaviour, including credit transaction records, public credit information, etc., which can affect an individual’s credit score.

Credit Blacklists: The system may include credit blacklists that record individuals or businesses with bad credit histories, which can negatively impact their credit applications.

Application Scenarios and Impact

Market Environment: Build an honest market, promote the honesty and trustworthiness of market entities, and improve market competitiveness and efficiency.

Credit Market: In the credit market, individuals and businesses with high credit scores have easier access to loans and credit cards, as they are the subject of competition between banks and financial institutions.

Social Governance: By building a culture of integrity, promote social entities to abide by laws and regulations, and maintain social order and public interests.

Public Services: Promote government departments to perform their duties and improve satisfaction with public service quality.

Personal Life: Promote self-discipline and self-improvement of individual subjects and improve the quality of personal life and happiness.

Create a Background

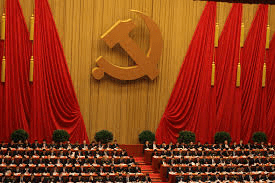

First, the need for the construction of the Social Credit System. The 18th National Congress of the Communist Party of China (2012) proposed to strengthen the construction of government integrity, business integrity, social integrity, and judicial credibility, establish and improve a credit reporting system covering the whole society, increase the punishment of untrustworthy behaviour, and form a cogent social atmosphere in which trustworthiness is honourable and dishonesty is shameful. This policy background has promoted the creation of the People’s Credit Evaluation System, aiming to standardize the market economic order, improve the market credit environment, reduce transaction costs, and prevent systemic financial risks through the Credit Evaluation System.

Second, the urgent need for financial services. There is a gap between China’s current financial service level and developed countries. The establishment of a Credit Evaluation System can improve the quantity and quality of financial services, reduce the bad debt rate, and improve the efficiency of financial services. The establishment of the People’s Credit Evaluation System is precisely to fill the gap in our country’s financial service infrastructure and improve the level of financial services.

Finally, the demand for market economic development. The market economy is a credit economy, and honesty and trustworthiness are the foundation of the market economy. However, untrustworthy behaviour is relatively common in our country, and it is necessary to record and punish untrustworthy behaviour through the Credit Evaluation System, encourage trustworthy behaviour, and promote the construction of social integrity.

Systematic Role

Help customers judge and control credit risks and carry out credit management activities; Carry forward the spirit of integrity, advocate honesty and abiding by contracts, and enhance the awareness of social integrity; publicize credit knowledge, credit policies and regulations, etc.

Chinese Language Text:

人民信用评价系统

人民信用网

2025-08-22 10:55

河北

人民信用评价系统 是一种通过量化分析评估个人或企业信用状况的工具,广泛应用于金融、企业管理、市场监管等领域。

基本定义

人民信用评价系统是中国社会信用体系建设的重要组成部分,旨在通过一套相关指标体系对经济主体的综合信用状况进行评估,促进社会诚信和规范化管理。根据“公正、客观、科学、公开”的原则,通过对信用主体的全面了解、考察调研和分析,作出有关其信用行为的可靠性、安全性程度的估量,并以专用符号或文字形式表达。

系统功能

信用评价:系统通过对企业及金融机构的基本素质、经营水平、财务状况、盈利能力、管理水平和发展前景等方面进行综合分析和评价,测定其履行各种经济契约的能力和可信任程度。

信用记录:系统记录个人的信用行为,包括信贷交易记录、公共信用信息等,这些记录会影响个人的信用评分。

信用黑名单:系统可能包含信用黑名单,记录那些有不良信用记录的个人或企业,这些信息会对他们的信贷申请产生负面影响。

应用场景和影响

市场环境:构建诚信市场,促进市场主体诚实守信,提升市场竞争力效率。

信贷市场:在信贷市场上,信用评分高的个人和企业更容易获得贷款和信用卡,因为他们是银行和金融机构争抢的对象。

社会治理:通过构建诚信文化,促进社会主体遵守法律法规,维护社会秩序和公共利益。

公共服务:促进政府部门履行职责,提高公共服务质量满意度。

个人生活:促进个人主体自律自强,提升个人生活品质幸福感。

创建背景

首先,社会信用体系建设的需要。党的十八大提出要加强政务诚信、商务诚信、社会诚信和司法公信建设,建立健全覆盖全社会的征信系统,加大对失信行为的惩戒力度,形成守信光荣、失信可耻的社会氛围。这一政策背景推动了人民信用评价系统的创建,旨在通过信用评价系统来规范市场经济秩序,改善市场信用环境,降低交易成本,防范系统性金融风险。

其次,金融服务的迫切需求。我国目前的金融服务水平与发达国家相比存在较大差距。建立信用评价体系可以提高金融服务的数量和质量,降低坏账率,提升金融服务效率。人民信用评价系统的创建正是为了填补我国金融服务基础设施上的空白,提高金融服务水平。

最后,市场经济发展的需求。市场经济是信用经济,诚实守信是市场经济的基础。然而,失信行为在我国较为普遍,需要通过信用评价系统来记录和惩罚失信行为,激励守信行为,从而推动社会诚信建设。

系统作用

帮助客户判断、控制信用风险,进行信用管理活动;弘扬诚信精神,提倡诚信守约,增强社会诚信意识;宣传信用知识、信用政策法规等。